Businesses that need more time to file their income tax returns can file Form 7004 on or before the deadline for an automatic 6-month extension of time to file.

Generally, businesses operating as S-Corporations and Partnerships must file Form 1120S and 1065 by March 15th, and businesses operating as C-Corporations and Trusts or Estates must file Form 1120 and 1041 by April 15th.

ExpressExtension, an IRS-authorized e-file provider for tax extension Forms, offers a complete solution for e-filing your Form 7004 securely and accurately.

Express Guarantee

If the IRS rejects your 7004 as a duplicate form, we automatically refund your filing fee.

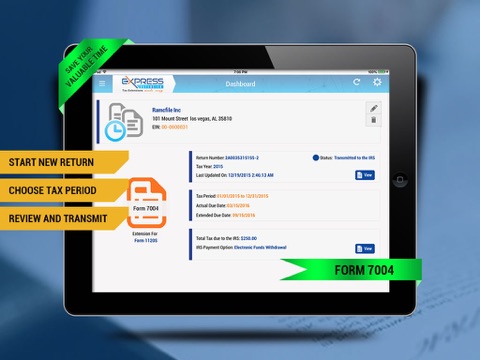

File an Extension in Minutes

Our app simplifies filing your business tax extension, and we notify you when the IRS approves your extension.

Option to Pay Tax Dues

You have the option to pay your balance due to the IRS while filing your extension.

Internal Audit Check

Error checks are built-in to the filing process to identify common errors before the form is transmitted to the IRS.

Instant Status Updates

Once your extension is transmitted, you will receive instant email notifications regarding the status of your form.

Retransmit Rejected Returns for Free

If your extension is rejected by the IRS, you can update and retransmit your form for free.

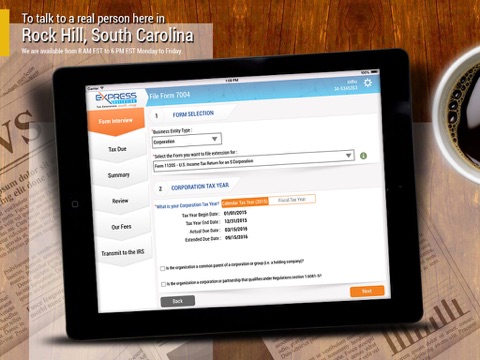

Follow these steps to e-file Form 7004:

> Download our app and create your ExpressExtension account.

> Select the form you want an extension for and the tax year.

> Enter the required form data and tax balance due (if any)

> Choose a payment method to pay the tax balance due to the IRS (EFW or EFTPS).

> Review the form summary and transmit it to the IRS.

If you have any more questions, you can contact our live support team at (803) 514-5155 or email [email protected].